EY Compliant Ethical CushonMix very high risk/return Lifetime ISA

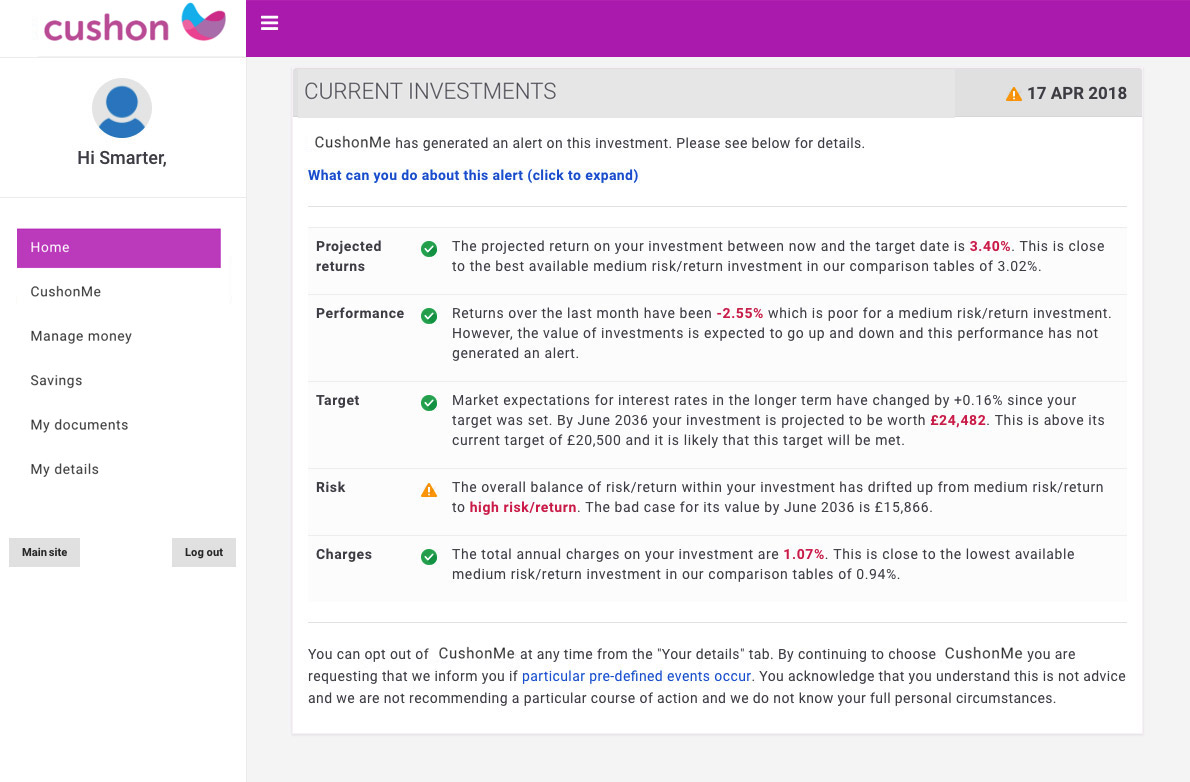

Free CushonMe

CushonMe is our free investment risk and performance monitoring service. Its powerful algorithms will check up on your investment every single day and send you an email if any of its alerts are triggered.

It’s completely free to you (we pay for it out of the flat 1.07 % pa charge for investing with us) and you can read more about CushonMe here. But if you'd prefer not to have CushonMe you can choose to opt out when you set up your account.

The daily review covers five key things:

-

Projected returns:

whether other investments in our comparison tables have significantly better projected returns

-

Performance:

the recent performance of your investment

-

Target:

whether your investment is on track to meet the targets you've specified

-

Risk / return:

whether the risk/return profile of your investment has changed because:

- there is now a significant risk of loss between now and your target date

- market conditions are unusually volatile

- the mix of your investment has drifted over time into a different risk / return category

-

Charges:

whether other investments in our comparison tables have significantly lower charges

One thing CushonMe won’t do is send you junk email. There are thresholds on each item to make sure we only alert you if it's really worth it.

CushonMe uses the same techniques as big financial services companies use to manage their own money, but it does not provide advice and you still make all your own decisions on what to do. We use sophisticated actuarial technology and we're the only people making this sort of powerful service available directly to consumers.

Charges

A breakdown of the charges for this investment is below. There are no other charges. You can switch funds, cash in your investment or transfer it to another provider for free at any time.

| Annual | Initial | Other | |

|---|---|---|---|

| Total charge | 1.07% | 0% | None |

| Platform charges | 0.79% | 0% | None |

| Fund managers' charges | 0.28% | 0% | None |

| L&G Future World Global Multi-Factor ESG Tilted and Optimised Index I Acc | 0.30% | 0% | None |

| L&G MSCI World Socially Responsible Investment (SRI) Index I Acc | 0.25% | 0% | None |

|

We make no initial charge on any of our investments. However, funds do incur dealing costs which they may pass on to you (at cost). Often these are free because funds get big economies of scale and can net trades off against each other, but if they do apply they are typically between 0% and 2% as a one-off cost. The fund managers' charges apply on a fund-by-fund basis. The total shown is based on the initial proportion invested in each fund. I have also seen and read the information on costs and charges |

|||

Everything online, safe and secure

With our easy to use online account you get everything in one place. No more lost paperwork. No more hassle.

From your account you can do all the standard things you'd expect to be able to do like:

- View your balance and recent transactions

- Pay money in, take money out, change direct debits and switch money between funds

- Update your address, bank and other details

But, because you're with Cushon, you'll also find thing you might not expect like:

- Up-to-date "good case" vs "bad case" projections of what your investment might be worth in future

- The latest results of our daily CushonMe review of you investment

- All your documents in one, easy-to-find, place

- Tools to help you if you want to change the target for your investment or change its level of risk/return

And our robust security measures mean you can be confident your money is safe and secure.