What is CushonMe?

CushonMe is a free service that automatically reviews your investments every day. The review looks at five key things:

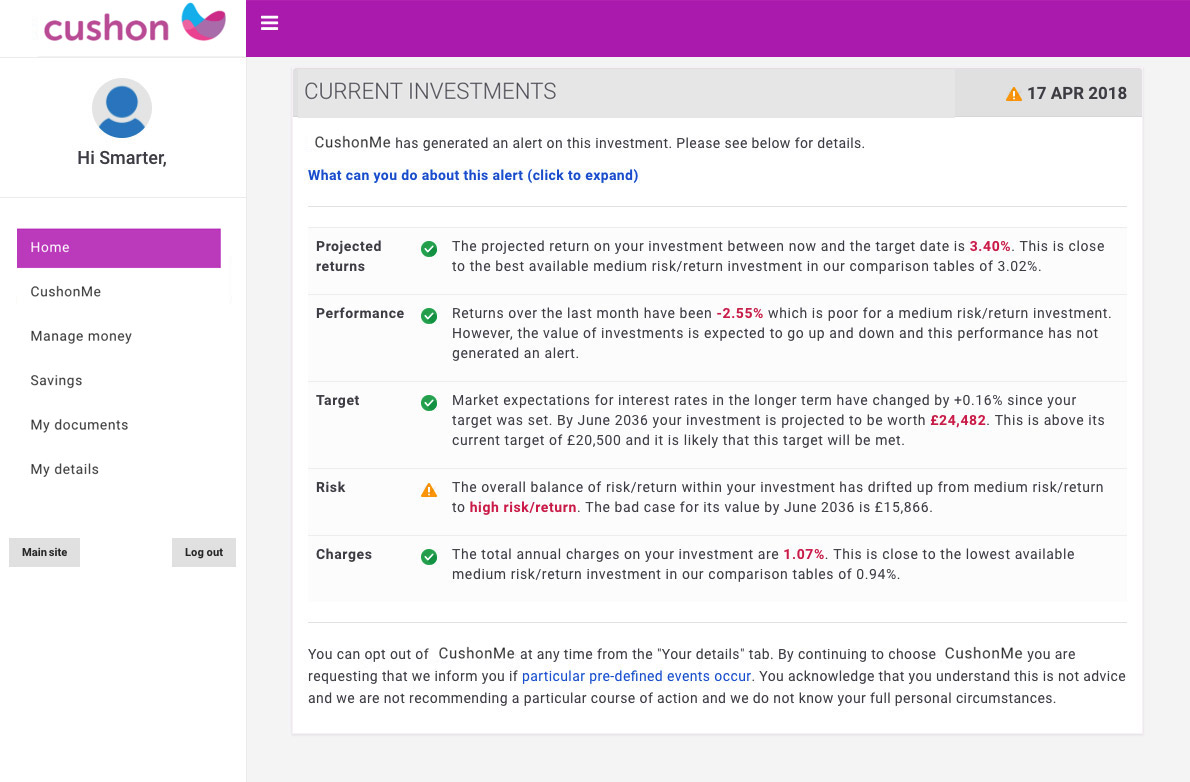

- Projected returns: whether other investments in our comparison tables have significantly better projected returns

- Performance: whether the recent performance of your investment has been particularly good or bad

- Target: whether your investment is on track to meet the targets you've specified

- Risk / return: whether the risk / return profile of your investment has changed because:

- the bad-case projected value of your investment has got substantially worse

- market conditions are unusually volatile

- the mix of your investment has drifted over time into a different risk / return category

- Charges: whether other investments in our comparison tables have similar projected returns but significantly lower charges

We also email you a summary each month and daily results are available in the CushonMe tab when you log in to your account.

The thresholds on each item are to make sure we only alert you if it's really worth it. For example, we won’t bother alerting you if a new fund is launched whose charges are 0.02% lower. But if markets are becoming more volatile and there is a significant risk of loss between now and your target date, we will let you know. Full details of the exact triggers and thresholds we use are below.

So does CushonMe provide advice on investing?

No, CushonMe will alert you to certain events, but you still make all your own decisions on what to do.

Sometimes the most obvious course of action might not be right for you. For example, it might not make sense for you to switch to an investment with higher projected returns if you are expecting to cash in your investment soon. In this case, you might be better off reducing the level of risk you are taking instead.

Our aim is to make it quicker and easier for you to invest your money sensibly. We provide some very powerful tools, but we cannot predict the future. Investing is always risky and there is always a chance that you get back less than you put in. You have to take responsibility for your own decisions and it is important that you understand the risks of investing.

Can CushonMe protect my money from stock market crashes?

It can't protect you from a crash, but it will alert you if market conditions are becoming unusually volatile and the risk category of your investments has increased. This helps you to act more quickly to mitigate potential losses, if that's what you want to do.

Stock market crashes don’t usually happen overnight. For example, the 2008 crash unfolded over a number of weeks and in the first few days various indicators of future market volatility went up significantly. CushonMe monitors these indicators and uses them to alert you if the risk category of your investment changes. This provides you the option of switching into lower risk / return investments which can protect you from the worst effects of a crash.

When exactly will CushonMe generate an alert?

The exact circumstances in which CushonMe will generate an alert are as follows:

| Review area | What we will do | Alert will be generated if |

|---|---|---|

| Projected returns | We will compare the projected returns on your investment to alternative investments in our comparison tables. | Alternative investments are identified with most likely projected returns more than 0.2% higher than your current investments and with the same level of risk |

| Charges | We will compare the total charges on your investment to alternative investments in our comparison tables. |

Alternative investments are identified with more than 0.2% lower charges and more than 0.2% higher most likely projected returns than your current investments and with the same level of risk.

(This means we will not alert you to lower charge investments unless they also have higher projected returns.) |

| Performance | We will calculate the return on your investment over the last rolling 1-month period |

Your investment has incurred losses of more than a certain percentage over the last month. The percentage loss that triggers an alert varies depending on the level of risk/return you have selected:

Risk / returnVery high

Percentage loss over last month12% or more

Risk / returnHigh

Percentage loss over last month8% or more

Risk / returnMedium

Percentage loss over last month6% or more

Risk / returnLow

Percentage loss over last month1% or more

|

| Targets | We will assess whether your investment is still on track to achieve the target you have specified (eg £10,000 by 1 Jan 2025). | There is a 60% or greater likelihood that your investment will not achieve your target |

| Risk / return | We will perform a “bad case” projection for the value of your investment on your target date and check it against the “bad case” when you last confirmed your risk/return selection or changed your target.. |

The “bad case” projected value of your investment on your target date falls substantially lower than it was when you last confirmed your risk/return selection or changed your target.

The threshold worsening in “bad case” for an alert to be generated varies depending on the level of risk/return you have selected as follows: Risk / returnVery high

Worsening in “bad case” that triggers an alert20% or more

Risk / returnHigh

Worsening in “bad case” that triggers an alert15% or more

Risk / returnMedium

Worsening in “bad case” that triggers an alert10% or more

Risk / returnLow

Worsening in “bad case” that triggers an alert5% or more

|

| We will assess the current overall risk / return category of your investment using our standard methodology (same as is used for our comparison tables). |

Market conditions are unusually volatile meaning your investments have a higher level of risk / return than you originally selected.

OR... Market conditions are unusually stable meaning your investments have a lower level of risk / return than you originally selected. OR...The mix of your investments has drifted over time meaning they have a higher level of risk / return than you originally selected. OR...The mix of your investments has drifted over time meaning they have a lower level of risk / return than you originally selected. |

|

| We will check how long it is since you last confirmed your risk / return selection | You have not confirmed your risk / return selection for more than two years |